Loading

Get Irs 656-b 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 656-B online

Filling out the IRS 656-B form, which pertains to Offer in Compromise, is a crucial step for individuals seeking to settle their tax liabilities for less than the full amount owed. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring you have the necessary information and support throughout the process.

Follow the steps to complete the IRS 656-B form online.

- Press the ‘Get Form’ button to access the IRS 656-B form, ensuring you have the latest version to begin filling it out.

- Gather all necessary financial information, including your overall assets, income, expenses, and future earning potential, as these will help in correctly calculating your offer.

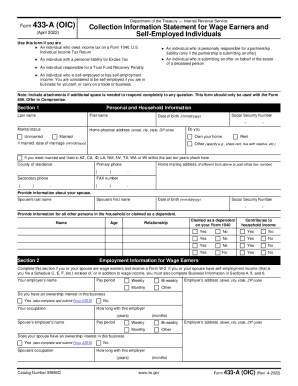

- Complete Section 1 of Form 656-B, which requires personal information and details about your tax liabilities.

- In Section 2, choose the option for either individual or business tax debts, providing the required details for each relevant tax period.

- Fill out Section 3, where you will declare the reason for your offer and provide any relevant supporting documentation that reflects your financial situation.

- Indicate your proposed payment terms in Section 4, selecting either a lump sum cash payment or periodic payments.

- Review the entirety of the form for accuracy. Ensure that all fields are completed and all required signatures are provided.

- Save your changes after completing the form, file it accordingly online, and keep a copy for your records before submitting it to the IRS.

Complete your IRS 656-B form online to begin your Offer in Compromise process and take a significant step toward resolving your tax liabilities.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For taxpayers facing a hefty tax bill, the IRS offers an option through its Debt Forgiveness program. However, it's essential to know the IRS grants debt forgiveness in rare cases, usually for those in extreme financial hardships.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.