Loading

Get Irs 990 - Schedule A 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule A online

Filling out the IRS 990 - Schedule A is essential for organizations seeking to maintain their tax-exempt status. This guide provides a step-by-step approach to ensure that users can complete this form accurately and efficiently online.

Follow the steps to fill out the IRS 990 - Schedule A with ease.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter the name of the organization and the employer identification number (EIN) in the designated fields at the top of the form.

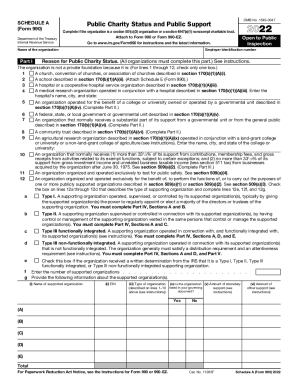

- In Part I, indicate the reason for the organization’s public charity status by checking the appropriate box from lines 1 to 12.

- Complete Part II by documenting the support schedule, including gifts, grants, and other public support received over the past year. Be sure to enter all relevant information accurately.

- In Part III, if applicable, fill out the support schedule for organizations described in section 509(a)(2) by listing all contributions and sources of support.

- Proceed to Part IV if you checked any boxes in Part I regarding supporting organizations. Provide detailed information about all supporting organizations and their relationships in the appropriate sections.

- Finally, review all entries for accuracy, then save changes to your document. You can choose to download, print, or share the completed form as needed.

Begin filling out the IRS 990 - Schedule A online today to ensure your organization remains compliant and eligible for tax-exempt status.

Schedule A (Form 990) is used by an organization that files Form 990, Return of Organization Exempt From Income Tax, or Form 990-EZ, Short Form Return of Organization Exempt From Income Tax, to provide the required information about public charity status and public support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.