Loading

Get Oh Declaration Of Estimated Tax - City Of Perrysburg 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH Declaration Of Estimated Tax - City Of Perrysburg online

Filing your estimated tax declaration can feel daunting, but with clear guidance, you can complete the OH Declaration Of Estimated Tax for the City Of Perrysburg efficiently. This guide provides step-by-step instructions, ensuring you navigate each section accurately.

Follow the steps to complete your declaration online.

- Click ‘Get Form’ button to obtain the OH Declaration Of Estimated Tax form and open it in your preferred digital editor.

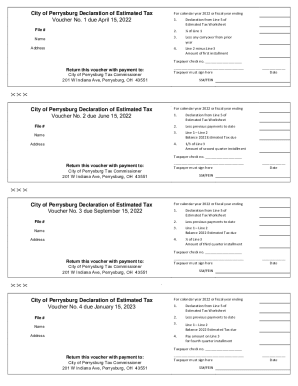

- Identify the correct voucher based on the payment schedule: Voucher No. 1 is due April 15, Voucher No. 2 is due June 15, Voucher No. 3 is due September 15, and Voucher No. 4 is due January 15 of the following year. Select the relevant voucher to fill out.

- In the 'File #' section, enter your unique file number, which can typically be found on previous tax documents or correspondence from the tax authority.

- In the 'Name' field, input your full legal name as it appears on official documents. Ensure accurate spelling to avoid issues with your filing.

- In the 'Address' section, provide your complete mailing address, including street, city, state, and zip code.

- For Line 1, enter the declaration from Line 5 of your Estimated Tax Worksheet, representing your total estimated tax for the year.

- On Line 2, note any carryover credits from the previous year that can reduce your tax liability.

- Calculate Line 4 by subtracting Line 3 from Line 2 to determine the first installment amount. Enter this figure in the designated space.

- For tax payments, write your taxpayer check number in the specified area, ensuring it corresponds to the payment you are submitting.

- Sign and date the form in the provided fields to validate your submission. Your signature confirms the accuracy of the information you entered.

- Review all information for accuracy before finalizing. You can then save your changes, download, print, or share the form as needed.

Complete your OH Declaration Of Estimated Tax online today to ensure timely submission and compliance.

The City of Perrysburg levies a tax of 1.5% on all salaries, wages, commissions, and other compensation, and on net profits earned within the city, as well as on income of residents earned outside the city.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.