Loading

Get Irs 1040 - Schedule 2 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 - Schedule 2 online

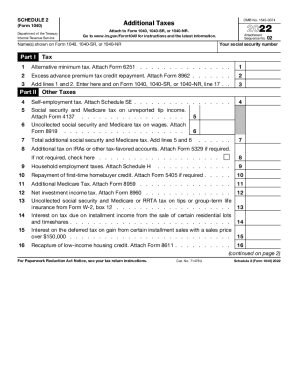

The IRS 1040 - Schedule 2 is a vital document for reporting additional taxes owed by individuals. This guide will provide you with a clear, step-by-step approach to completing this form online, ensuring you understand each part of the document and fulfill your tax obligations accurately.

Follow the steps to complete Schedule 2 effectively.

- Click the ‘Get Form’ button to access the IRS 1040 - Schedule 2 form and open it in your preferred editor.

- Enter your social security number and the name(s) shown on your Form 1040, 1040-SR, or 1040-NR at the designated fields.

- Part I requires you to report additional taxes. Start with line 1 for alternative minimum tax, and ensure you attach Form 6251 as instructed.

- For line 2, if applicable, report any excess advance premium tax credit repayment by attaching Form 8962.

- Add the amounts from lines 1 and 2 in line 3; this total should be transferred to Form 1040, 1040-SR, or 1040-NR, line 17.

- Proceed to Part II to report other taxes. For line 4, indicate your self-employment tax by attaching Schedule SE.

- If you have any unreported tip income, fill out line 5 by attaching Form 4137.

- Enter any uncollected social security and Medicare tax on wages in line 6 and attach Form 8919.

- Calculate the total additional social security and Medicare tax by adding lines 5 and 6; report this in line 7.

- For line 8, if applicable, note any additional tax on IRAs or tax-favored accounts, attaching Form 5329 when necessary.

- Continuing through lines 9 to 21, fill in any other applicable taxes as instructed, ensuring to attach the required forms for each.

- Once all sections are completed, review the form for accuracy, then save your changes, download, print, or share the completed Schedule 2.

Start filing your IRS 1040 - Schedule 2 online today to ensure timely and accurate tax reporting.

What does this mean? If you have an additional amount on Line 8 of your Schedule 2, this means that there is an additional tax being calculated based on information that you entered into your account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.