Loading

Get Irs 8815 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8815 online

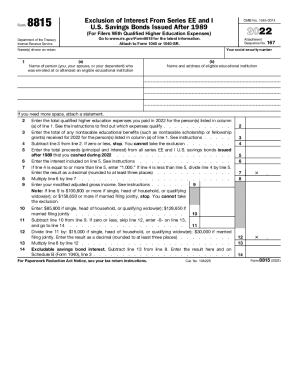

Filing your taxes can be a complex process, but understanding how to fill out specific forms can simplify your experience. This guide provides step-by-step instructions on how to complete the IRS form 8815 online, ensuring you can successfully exclude interest from your U.S. savings bonds.

Follow the steps to fill out the IRS 8815 online with ease.

- Click 'Get Form' button to obtain the form and open it for editing.

- Enter your social security number and the name(s) shown on your return.

- In line 1(a), write the name of the person who attended an eligible educational institution. In line 1(b), provide the name and address of the institution.

- For line 2, list the total qualified higher education expenses for the individual(s) from line 1(a). Ensure you understand which expenses qualify.

- For line 3, enter any nontaxable educational benefits received for the individual(s) in line 1(a).

- Complete line 4 by entering the total proceeds from the series EE and I U.S. savings bonds you cashed during the year.

- On line 5, enter the interest included from line 4.

- For line 6, if applicable, calculate the portion of interest to exclude and enter the result.

- In line 9, enter your modified adjusted gross income and follow any necessary instructions to determine eligibility.

- Finally, review all entries for accuracy, then save changes, download the document, and print or share it as needed.

Complete your documentation online and ensure you're ready for tax season.

If you cashed series EE or I U.S. savings bonds this year that were issued after 1989, you may be able to exclude from your income part or all of the interest on those bonds. Use Form 8815 to figure the amount of any interest you may exclude.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.