Loading

Get Irs 8959 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8959 online

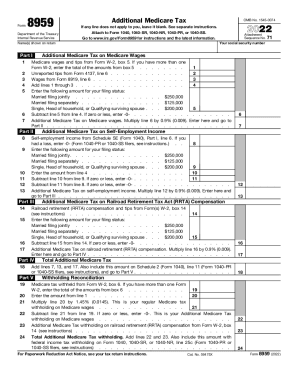

The IRS 8959 form is essential for reporting the Additional Medicare Tax. This guide provides detailed instructions on how to accurately complete this form online, ensuring you meet all necessary requirements.

Follow the steps to successfully fill out and submit the IRS 8959 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter your social security number and name(s) shown on your return in Part I.

- In Part II, report your Medicare wages and tips from Form W-2, box 5, along with any unreported tips and wages from Form 8919.

- Subtract the corresponding line amounts based on your filing status from the previously entered total to determine if any Additional Medicare Tax applies.

- In Part III, calculate and enter the Additional Medicare Tax on Medicare wages by multiplying the result from the previous step by 0.9%.

- Proceed to Part IV to account for self-employment income and follow the same procedure as in Part II, calculating the Additional Medicare Tax as required.

- For Part V, if applicable, follow the same procedure for Railroad Retirement Tax Act (RRTA) compensation.

- Finally, review all entries for accuracy, and then save changes, download, print, or share the form as necessary.

Ensure your tax documents are completed accurately by filing the IRS 8959 online now.

The Additional Medicare Tax applies to people who make more than a set income level for the year....If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as: flexible spending accounts (FSA) health savings accounts (HSA) retirement accounts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.