Loading

Get Irs 1041-es 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041-ES online

This guide will help you navigate the process of filling out the IRS Form 1041-ES online, which is used to calculate and remit estimated income tax for estates and trusts. This comprehensive overview aims to support users at all levels of experience with tax documentation.

Follow the steps to successfully complete your IRS 1041-ES form online.

- Press the ‘Get Form’ button to access the form and open it in your chosen editor.

- Identify the name of the estate or trust at the top of the form, where it asks for the name and employer identification number (EIN). Fill in the appropriate details accurately.

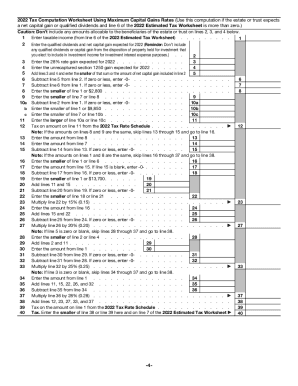

- Proceed to calculate the expected income for the estate or trust for the year and enter this on the designated line for adjusted total income.

- Complete the Exemption section according to the type of entity. For decedents' estates, enter $600; for trusts distributing all income, enter $300; or for qualified disability trusts, enter $4,400.

- Calculate the taxable income by subtracting any deductions from the total income posted earlier.

- Use the IRS Tax Rate Schedule to figure the tax owed based on your taxable income and enter this on the relevant line.

- Input any expected credits the estate or trust may claim on the appropriate lines.

- Complete the section related to Other Taxes, including any applicable taxes such as Net Investment Income Tax.

- Review the payment vouchers provided in the form. Complete each voucher with the correct due date and the amount you are paying.

- After all fields are filled appropriately, you can save your changes, download a copy of the completed form, print it, or share it as necessary.

Complete your IRS 1041-ES form online today to meet your estimated tax obligations.

When are taxes due in 2023? April 18, 2023, was tax day, the deadline for filing a federal income tax return. If you requested a six-month tax extension using Form 4868, that deadline was Monday, Oct. 16, 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.