Loading

Get Lender Acknowledgement Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Lender Acknowledgement Form online

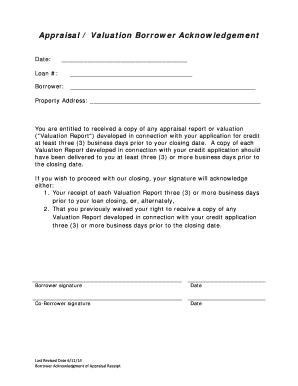

Completing the Lender Acknowledgement Form online is an essential step in securing your loan. This guide will provide clear instructions to help you fill out each section of the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred format for editing.

- In the first section, enter the borrower's name in the designated field. Ensure the name is spelled accurately, as it reflects legal identification.

- Provide the property address in the following section. This should include the full address to clarify the location associated with the loan.

- Review the acknowledgment statement regarding the receipt of Valuation Reports. Confirm that you have received these reports at least three business days prior to closing by selecting the appropriate acknowledgment option.

- Once you have made your acknowledgment, proceed to sign and date the form in the signature section provided for the borrower.

- If there is a co-borrower, ensure they also sign and date the form in the designated area.

- After filled out, review the entire form for completeness and accuracy. Make any necessary edits before finalizing.

- Once you are satisfied with the form, you can save your changes, download it for your records, print a copy, or share it as needed.

Complete your documents online today for a smoother loan process.

Filling out an acknowledgement form requires careful attention to detail. First, ensure you write your full name, the date of acknowledgment, and the nature of the document. It's essential to review the information to avoid any errors before submitting. For assistance, US Legal Forms offers templates specifically for this purpose, guiding you through each step.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.