Loading

Get Irs 8027 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8027 online

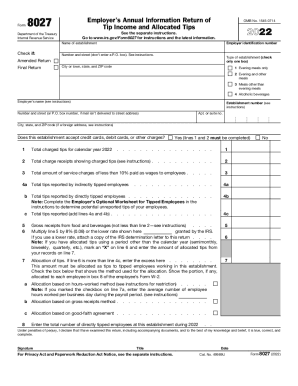

The IRS 8027 form is an essential document for employers to report tip income and allocated tips for their establishments. This guide provides clear and supportive instructions to help users complete this form accurately and efficiently online.

Follow the steps to successfully complete the IRS 8027 online.

- Click ‘Get Form’ button to obtain the form and open it for filling out.

- Enter your employer identification number in the designated field. This number is crucial for your tax identification.

- Provide the name of your establishment as it is registered. Ensure accuracy to avoid processing delays.

- Fill in the street address, avoiding P.O. box numbers unless necessary, followed by the city, state, and ZIP code.

- Select the type of establishment by checking only one box. Options include 'Evening meals only', 'Evening and other meals', 'Meals other than evening meals', or 'Alcoholic beverages'.

- Indicate if you are submitting an amended return or a final return by marking the appropriate box.

- Provide the total charged tips for the calendar year in the specific field indicated.

- Record the total charge receipts showing charged tips. This must match or exceed the value from the charged tips.

- Complete the section for total service charges paid as wages to employees if applicable.

- Report the total tips from both indirectly and directly tipped employees carefully. Make sure to calculate accurately.

- If allocated tips were determined using a period other than the calendar year, indicate accordingly in the relevant section.

- Allocate tips based on the chosen method and enter the necessary details for each employee as required.

- Finally, review the entire form for accuracy, sign where indicated, and include your title and date.

- After completing the form, you may save changes, download, print, or share the form as needed.

Complete your IRS 8027 form online today to ensure compliance and accuracy in reporting tip income.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

For purposes of Form 8027, the customer for whom a work site employee performs services (that is, the employer who operates a large food or beverage establishment) is considered the employer and must file Form 8027. The CPEO must furnish to the customer any information necessary to complete this form.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.