Loading

Get Irs 8801 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8801 online

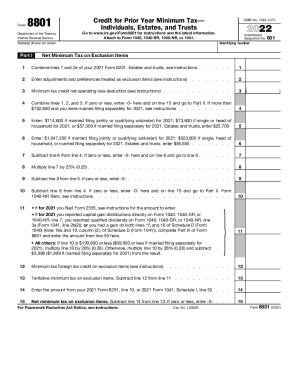

The IRS 8801 form is used to claim a credit for prior year minimum tax, applicable for individuals, estates, and trusts. This guide provides a clear step-by-step process to assist you in completing this form online.

Follow the steps to fill out the IRS 8801 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your identifying information, including the name(s) shown on your return and the appropriate identifying number.

- In Part I, start by combining lines 1 and 2e from your 2021 Form 6251 and enter the total in line 1.

- Next, enter any adjustments and preferences treated as exclusion items on line 2.

- Complete line 3 with the minimum tax credit net operating loss deduction.

- Add the amounts from lines 1, 2, and 3 on line 4. If the total is zero or less, enter -0- and proceed to Part II; if over the specified limits for married filing separately, refer to the instructions.

- For line 5, enter the appropriate threshold amount based on your filing status (e.g., $114,600 if married filing jointly).

- Similarly, for line 6, enter the corresponding amount based on your filing status and proceed to the next calculation.

- Subtract line 6 from line 4 and enter this result in line 7. If zero or less, enter -0-.

- Multiply the amount from line 7 by 25% and place the result in line 8.

- Finally, subtract line 8 from line 5 and enter the result in line 9. If zero or less, enter -0-.

- Follow similar steps for the remaining sections of Part I and complete Parts II and III as necessary.

- Review your entries for accuracy, and once completed, you can save changes, download, print, or share the form as needed.

Complete your IRS 8801 online to ensure you claim your eligible credits accurately.

Go to .irs.gov/Form8801 for instructions and the latest information. Attach to Form 1040, 1040-SR, 1040-NR, or 1041. 11 • If for 2021 you filed Form 2555, see instructions for the amount to enter.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.