Loading

Get Section 48

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Section 48 online

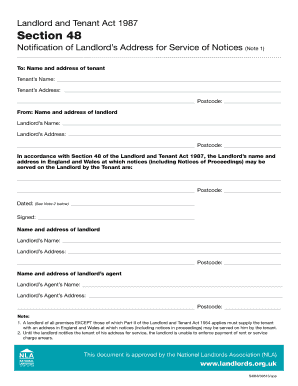

This guide provides a clear and supportive overview of how to complete the Section 48 form, which is essential for landlords to notify tenants of their address for service of notices. Following these instructions will ensure a smooth process for both landlords and tenants.

Follow the steps to complete the Section 48 form.

- Press the ‘Get Form’ button to access the Section 48 form and open it in your editor.

- In the first section, enter the tenant's details. Fill in the tenant's name and address, ensuring accuracy for effective communication.

- Next, provide the landlord's information. Input the landlord's name and address, following the same guidelines for accuracy.

- Complete the designated space that outlines the landlord's address in England and Wales, where notices may be served. This is crucial for legal compliance.

- In the 'Dated' section, note the current date, as this will confirm when the notice was prepared.

- The landlord needs to sign the form, affirming the stated information is correct.

- If applicable, fill out the section for the landlord’s agent details, providing their name and address as necessary.

- Finally, review all entries for accuracy, and make any needed changes before finalizing the document.

- Save changes, and you may choose to download, print, or share the completed form as required.

Complete your documents online to ensure compliance and ease of management.

Section 48E pertains specifically to clean electricity investments and provides substantial tax benefits. This section encourages the use of renewable energy by offering tax credits that can offset investment costs. Understanding Section 48E enables you to make informed decisions about your investments in clean energy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.