Loading

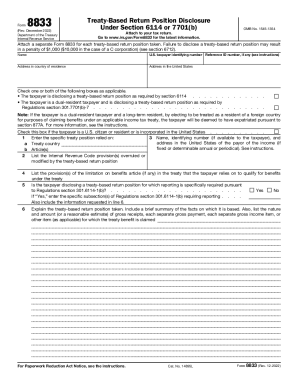

Get Irs 8833 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8833 online

Completing the IRS 8833 form is essential for taxpayers taking a treaty-based return position. This guide provides clear step-by-step instructions to help you fill out the form online accurately and efficiently.

Follow the steps to complete the IRS 8833 form online.

- Click ‘Get Form’ button to access the IRS 8833 form and open it in your preferred online editor.

- Enter your name and U.S. taxpayer identifying number at the top of the form. This may be your Social Security number or Individual Taxpayer Identification Number.

- Provide your address in your country of residence, ensuring to use the proper order and format as specified in the instructions.

- Fill in your address in the United States to clarify your tax status.

- Check the appropriate box to indicate if you are disclosing a treaty-based return position per section 6114 or if you are a dual-resident taxpayer under Regulations section 301.7701(b)-7.

- In line 1, specify the treaty position you are relying upon to claim benefits.

- List any Internal Revenue Code provisions overruled or modified by your treaty-based return position in line 2.

- For line 3, provide the name and address in the U.S. of the payor of the income, along with the relevant tax treaty article numbers.

- Line 4 requires you to note the provisions of the limitation on benefits article that you are relying on.

- Answer the question in line 5 regarding whether reporting is specifically required and provide the relevant subsection if applicable.

- In line 6, explain the treaty-based return position you are taking, summarizing the facts and providing necessary income details.

- Once all sections are complete, review the form for accuracy before saving your changes, downloading, printing, or sharing the completed IRS 8833 form.

Start your online IRS 8833 form now to ensure your treaty-based return position is properly disclosed.

Related links form

The payee must file a U.S. tax return and Form 8833 if claiming the following treaty benefits: A reduction or modification in the taxation of gain or loss from the disposition of a U.S. real property interest based on a treaty. A change to the source of an item of income or a deduction based on a treaty.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.