Loading

Get Irs 8582 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8582 online

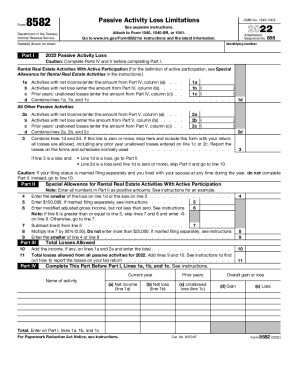

The IRS 8582 form is used to report passive activity losses and limitations. Filling out this form online can streamline the process and ensure accuracy. This guide will provide you with step-by-step instructions to help you complete the form effectively.

Follow the steps to complete the IRS 8582 online.

- Press the ‘Get Form’ button to access the IRS 8582 and open it in your preferred document editor.

- Complete Parts IV and V before filling out Part I, as instructed. These sections are critical for accurately reporting net income and losses from passive activities.

- In Part I, provide the net income from rental real estate activities with active participation in line 1a, total net losses from line 1b, and any prior years’ unallowed losses in line 1c. Then, combine these amounts in line 1d.

- For all other passive activities, enter the net income in line 2a, total net losses in line 2b, and prior years’ unallowed losses in line 2c. Total these in line 2d.

- Combine the totals from lines 1d and 2d and enter it in line 3. If this total is zero or more, include this form with your return and report the losses as usual.

- If line 3 is a loss, determine the next steps based on the loss in line 1d and line 2d according to the instructions provided.

- Progress to Part II as needed, reporting the smaller loss from line 1d or line 3 in line 4, and follow the instructions for entering modified adjusted gross income and calculating allowed losses in subsequent lines.

- Once all parts are accurately filled, review your entries for correctness. You can then save your changes, download the completed form, print it, or share it as necessary.

Start completing your IRS 8582 form online today to ensure all passive activity losses are reported correctly.

A taxpayer who is materially participating in an activity is allowed to deduct the total amount of losses on their taxes. Under passive activity rules, a taxpayer who is passively participating in an income-generating activity is limited in the deductibility of losses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.