Loading

Get La Lat 5a 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA LAT 5A online

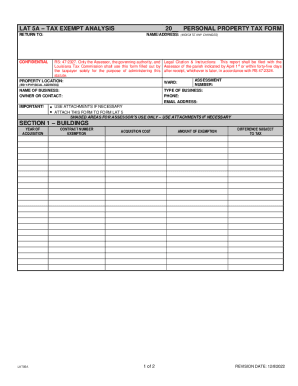

Filling out the LA LAT 5A form is a crucial step for taxpayers seeking tax exemptions on personal property. This guide provides a clear, step-by-step approach to help you navigate the online completion of this form effectively.

Follow the steps to complete the LA LAT 5A efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Provide your name and address, indicating any changes as may be necessary. This section is essential for proper identification and communication.

- Fill in the property location, including the E911 or physical address where the property is situated.

- Enter the name of the business, along with the owner or contact person's details, including phone number and email address.

- Complete the assessment number and type of business fields to provide specific details regarding your business classification.

- In Section 1, for buildings, list the year of acquisition, contract number, exemption applicable, and acquisition cost. Also, indicate the amount of exemption and the difference that is subject to tax.

- Section 2 requires you to group machinery and equipment by year of acquisition. For each entry, fill out the year, contract number, exemption, acquisition cost, description, amount of exemption, and difference subject to tax.

- In Section 3 for furniture and fixtures, similarly, group items by year of acquisition and provide the necessary details regarding each item's valuation.

- Section 4 pertains to consigned goods and rented equipment. Provide the name and address, property description, monthly rental fee, age, present-day selling price, and fair market value.

- Review all entries for accuracy. Once confirmed, you can save your changes, download, print, or share the completed form.

Complete your LA LAT 5A form online today for a seamless tax exemption application.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Louisiana Property Tax Rates The property tax rates that appear on bills are denominated in millage rate. A mill is equal to $1 of tax for every $1,000 of net assessed taxable value. If your net assessed taxable value is $10,000 and your total millage rate is 50, your taxes owed will be $500.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.