Loading

Get About Form 8915-f, Qualified Disaster Retirement Plan Distributions And ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the About Form 8915-F, Qualified Disaster Retirement Plan Distributions online

This guide provides a clear and supportive approach to filling out the About Form 8915-F, which is used for reporting qualified disaster retirement plan distributions. Whether you are familiar with tax forms or new to the process, this step-by-step guide will assist you in completing the form accurately and efficiently.

Follow the steps to successfully complete the About Form 8915-F online.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Enter your social security number in the designated field on the form.

- Provide your name accurately. If you are married and both spouses are required to file Form 8915-F, ensure each spouse submits a separate form.

- Fill in your home address, including number and street or P.O. box. This should be followed by your city, state, and ZIP code. If you have a foreign address, complete the relevant fields.

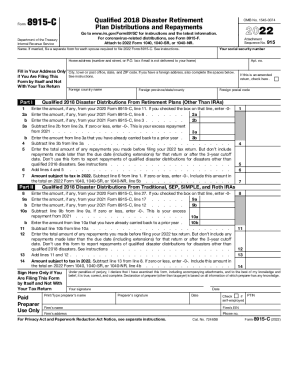

- Complete Part I, starting with line 1. Enter the amount from your previous Form 8915-C where indicated. If you checked a specific box on that form, input -0-.

- Continue filling out lines 2a and 2b. For line 2a, input the amount from your 2021 Form 8915-C, and for line 2b, subtract it as instructed.

- For line 3, enter any amounts you have already carried back to prior tax years from line 3a. Ensure to complete line 3b accordingly.

- On line 4 and line 5, add the total amounts of repayments made. Follow the prompts closely regarding the timing of these repayments.

- Calculate the amount subject to tax in 2022 on line 6 by subtracting line 6 from line 1. If the result is zero or less, enter -0-.

- Move to Part II and repeat the process for lines 8, 9a, 9b, and 10a, ensuring all amounts are accurate and reflect previous years' distributions and repayments.

- Finally, review all entries for accuracy. Once completed, you can save your changes, download, print, or share the form as needed.

Start filling out your Form 8915-F online to ensure compliance and stay updated on your retirement plan distributions.

Form 8915-F is a forever form. The same Form 8915-F will be used for distributions for qualified 2020 disasters (and qualified 2021 and later disasters, if enacted) and for each year of reporting of income and repayments of those distributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.