Loading

Get Irs 940 - Schedule A 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940 - Schedule A online

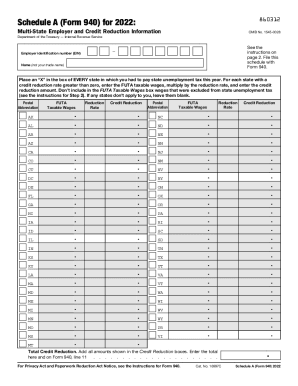

Filling out the IRS 940 - Schedule A can be a straightforward process when you approach it step by step. This guide provides comprehensive instructions to help you accurately complete the form online, ensuring compliance with federal tax obligations while taking advantage of available credits.

Follow the steps to complete the IRS 940 - Schedule A online

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- In the section for state unemployment tax, place an 'X' in the box for every state, including the District of Columbia, Puerto Rico, and the U.S. Virgin Islands, where you paid state unemployment taxes. Ensure that you do this even if the state has a credit reduction rate of zero.

- To calculate the credit reduction, multiply the FUTA taxable wages by the state’s reduction rate. Enter the resulting amount in the credit reduction box for that state.

- Once all fields are completed accurately, you can save your changes, download, print, or share the completed form as necessary.

Complete your IRS 940 - Schedule A online today for timely compliance!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.