Loading

Get Irs 5472 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 5472 online

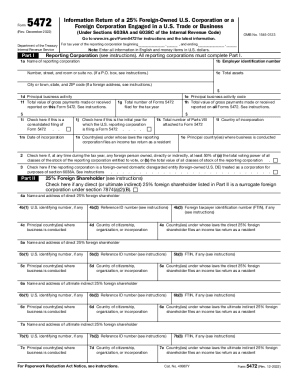

The IRS 5472 form is a critical document for reporting information about foreign ownership in U.S. corporations and the monetary transactions between them. This guide provides step-by-step instructions to help users successfully complete and file the IRS 5472 online.

Follow the steps to complete the IRS 5472 form successfully.

- Click the ‘Get Form’ button to obtain the IRS 5472 form and open it in the online editor.

- Enter the tax year for the reporting corporation at the beginning and ending fields.

- Fill out the name of the reporting corporation, followed by its employer identification number.

- Provide the total assets of the reporting corporation in U.S. dollars.

- Complete the address fields, including street, city, state, and ZIP code.

- Specify the principal business activity and enter the corresponding business activity code.

- Indicate the total value of gross payments made or received, reporting in U.S. dollars.

- Check the box if this submission is a consolidated filing of Form 5472.

- List the total number of Forms 5472 being filed for the tax year.

- Mark whether this is the initial year the U.S. reporting corporation is filing the form.

- Enter the date of incorporation for the reporting corporation.

- Detail the country of incorporation and the countries where business is conducted.

- Proceed to Part II and provide information regarding any 25% foreign shareholders.

- Complete Part III, detailing any related parties and their business information.

- Fill out Part IV, focusing on the monetary transactions between the reporting corporation and foreign related parties.

- Continue to complete subsequent parts of the form as required, providing all necessary details.

- After filling out the form, review all entered information for accuracy.

- Save changes, download, print, or share the completed form as needed.

Complete your filing of Form 5472 online for accurate compliance.

Purpose of Form Use Form 5472 to provide information required under sections 6038A and 6038C when reportable transactions occur during the tax year of a reporting corporation with a foreign or domestic related party.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.