Loading

Get P Tax Code Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P Tax Code Form online

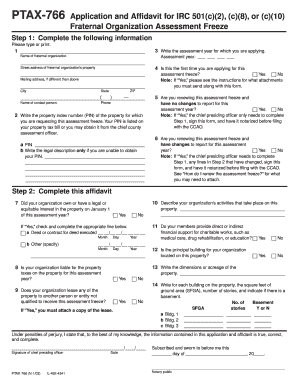

This guide provides clear and supportive instructions for completing the P Tax Code Form online. By following these steps, users will be able to efficiently fill out the required information and ensure compliance with the applicable tax regulations.

Follow the steps to fill out the P Tax Code Form online.

- Press the ‘Get Form’ button to access the P Tax Code Form and open it in the online editor.

- Begin by providing the necessary information in the designated fields. Start with the name of the fraternal organization in the first field. Ensure that the text is typed clearly, as this information is crucial for identification.

- Enter the assessment year for which you are applying in the specified field. This year will determine the applicable tax considerations.

- Complete the street address of the organization's property. If applicable, provide an alternate mailing address in the next field.

- Fill in the contact person's name along with their phone number. This information is important for correspondence related to the application.

- Input the property index number (PIN) found on the property tax bill or obtained from the chief county assessment officer.

- Indicate whether this is the first application for the assessment freeze by selecting 'Yes' or 'No.' If 'Yes,' refer to the instructions for required attachments.

- If renewing the assessment freeze without changes, select 'Yes' and complete step 1. If renewing with changes, select 'Yes,' complete step 1, and any relevant lines in step 2, then have the form notarized.

- Proceed to the next section and describe the activities of the organization that occur on the property.

- Answer the remaining questions regarding financial support for charitable works, the location of the principal building, and provide additional property details as required.

- Finalize the form by signing it. Ensure the signature is from the chief presiding officer and include the date.

- After completing all necessary fields, save your changes. You may then download, print, or share the completed form as needed.

Complete your documents online now!

You can file your tax return by yourself, and many people choose to do so successfully each year. Start by gathering all necessary information and obtaining the correct forms, such as the P Tax Code Form. Use reliable tax preparation software to guide you through the process. With a little effort, you can easily complete your return independently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.