Loading

Get Irs 1065 - Schedule K-3 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1065 - Schedule K-3 online

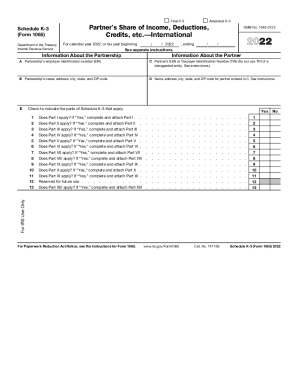

The IRS 1065 - Schedule K-3 is a crucial document for partnerships to report international income, deductions, and credits attributable to partners. This guide will assist users in completing the form accurately in an online format, ensuring compliance with IRS regulations.

Follow the steps to complete the IRS 1065 - Schedule K-3 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the partnership's employer identification number (EIN) in the designated field. This is essential for identifying the partnership involved.

- Fill in the partner's social security number (SSN) or taxpayer identification number (TIN) in the appropriate section, ensuring this does not include a TIN of a disregarded entity.

- Provide the partnership's full name along with its address, including city, state, and ZIP code. Accurate information here helps in official processing.

- Enter the partner's name and address, similar to the partnership section. Ensuring the correct identification of partners is vital for reporting.

- Mark the boxes to indicate which parts of Schedule K-3 apply to this submission. Take care to review the instructions for guidance on which parts to complete.

- Continue to complete each relevant part of the form based on partner-specific income, deductions, and credits. Each section has specific calculations and data fields.

- Review and ensure all sections of the form are filled out completely and accurately, as incomplete information can lead to processing delays.

- Once all information has been entered, users can save their changes, download the completed form for records, print it for submission, or share it as needed.

Start competing documents online to ensure timely filing and compliance.

Schedules K-2 and K-3, including any required attachments, are required for partnership (domestic or foreign) and S corporation taxpayers (those taxpayers required to file Form 1065 (U.S. Return of Partnership Income), Form 1120-S (U.S. Income Tax Return for an S Corporation) and taxpayers required to file Form 8865 ( ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.