Loading

Get Irs 8898 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8898 online

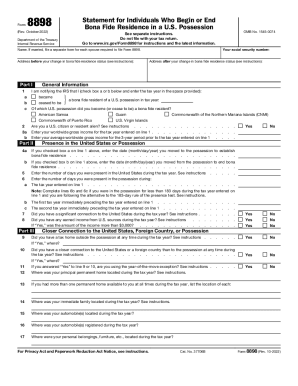

Filling out IRS Form 8898 is an important step for individuals who begin or end bona fide residence in a U.S. possession. This guide provides clear, step-by-step instructions for completing the form online and ensuring your information is accurate.

Follow the steps to complete the IRS 8898 online effectively.

- Click ‘Get Form’ button to access the IRS 8898 form and open it in your preferred editing tool.

- Enter your social security number in the designated field at the top of the form. This is crucial for identification purposes.

- Fill in your name. If you are married, ensure to file a separate form for each spouse who needs to submit Form 8898.

- Provide your address before your change in bona fide residence status. This information is necessary for the IRS records.

- In Part I, check either box 'a' or 'b' to indicate whether you became or ceased to be a bona fide resident of a U.S. possession during the specified tax year.

- Specify which U.S. possession you are reporting for, such as American Samoa, Guam, or Puerto Rico.

- Indicate if you are a U.S. citizen or resident alien by marking 'Yes' or 'No'.

- Enter your worldwide gross income for the tax year mentioned.

- Provide your average worldwide gross income for the three-year period preceding the tax year entered.

- If applicable, complete the fields in Part II regarding your presence in the United States or possession—is crucial for your declaration.

- Complete lines that ask for days present in the United States and the possession during the tax year.

- If you had a significant connection to the U.S., indicate that appropriately in the given section.

- Proceed to fill out details regarding your personal connections, banking, and where you derived most of your income.

- Review the questions in Part IV regarding business activities and transactions within the possession, marking 'Yes' or 'No' as necessary.

- Before submitting, ensure all responses are accurate, then sign and date the form.

- Finally, save the changes made, and you can download, print, or share your completed Form 8898 as needed.

Complete your IRS 8898 online today to ensure your residency status is accurately reported.

Form 8888 is available online at the IRS Forms, Instructions & Publications website by typing “8888” in the search box. You can also obtain it by contacting your nearest IRS Taxpayer Assistance Center or checking at your local library, post office, bank, or even at some large grocery stores.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.