Loading

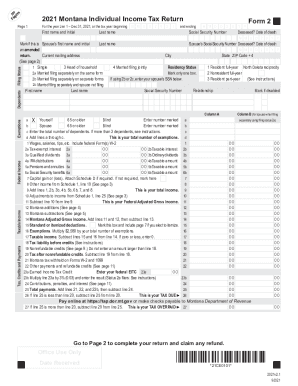

Get Mt Form 2 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT Form 2 online

This guide provides a comprehensive and user-friendly overview of how to fill out the MT Form 2 online. We will walk you through each section of the form, ensuring that you have the information you need to complete it accurately and efficiently.

Follow the steps to complete the MT Form 2 online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editor for online completion.

- Fill in the taxpayer's first name, middle initial, and last name as well as their Social Security Number. If the individual is deceased, indicate their date of death.

- Complete the Tax, Credits, and Payments section by entering the appropriate fields including taxable income, exemptions, and filing status. Ensure to mark if it is the spouse's name or if you are filing an amended return.

- Enter the current mailing address including city, state, and ZIP code. Be sure to check if the residency status options reflect your situation correctly.

- Proceed to report all types of income including wages, interests, dividends, and any other income sources. Ensure you follow the guidelines on what to include.

- Deduct any adjustments to your income as detailed in the form. This includes specific forms and schedules that may need to be completed.

- Calculate your total income and Montana-specific additions and subtractions to arrive at your Montana Adjusted Gross Income.

- Determine standard or itemized deductions applicable to your situation, and calculate exemptions based on your dependents.

- Complete the tax liability section, including any credits for payments already made or applicable deductions.

- After double-checking your entries, you can now save your changes, download, print, or share the completed form as required.

Take the next step to file your MT Form 2 online efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Who is eligible to file ITR-2 for AY 2021-22? Do not have income from profit and gains of business or profession and also do not have income from profits and gains of business or profession in the nature of: interest. salary.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.