Loading

Get Mo Mo-5090 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-5090 online

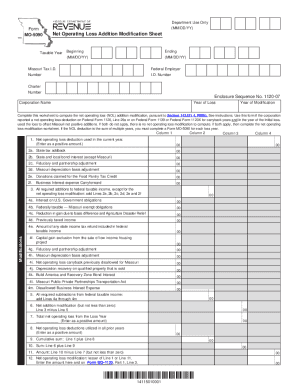

Completing the MO MO-5090, the net operating loss addition modification sheet, can seem daunting. This guide will help you through each section of the form, ensuring you accurately report your financial information.

Follow the steps to complete the MO MO-5090 efficiently.

- Press the ‘Get Form’ button to access the MO MO-5090 form and open it in the editor.

- Enter your taxable year, specifying the beginning and ending dates using the MM/DD/YY format.

- Input your Missouri Tax I.D. number, Federal Employer Identification Number, and Charter Number as required.

- List the year of loss and the year of modification as indicated on the form.

- In Column 1, Line 1, input the net operating loss deduction used in the current year as a positive amount.

- Complete Lines 2a through 2f by entering any state tax addbacks and other required additions to federal taxable income as applicable.

- Sum the amounts on Lines 2a through 2f and enter the total on Line 3.

- For subtractions, enter required amounts on Lines 4a through 4m as specified by the form.

- Add the values on Lines 4a through 4m and input the total on Line 5, completing the necessary subtractions.

- Subtract Line 5 from Line 3 and enter that value on Line 6, ensuring it is not less than zero.

- Record the total amount of the net operating loss from the loss year in Column 3.

- Indicate the amount utilized from prior years as on Federal Form 1120, and complete the following lines to calculate total modifications.

- Finalize by entering the lesser of Line 1 or Line 11 on Line 12. This is your net operating loss modification.

Complete your MO MO-5090 form online today for accurate reporting!

The Act included a provision limiting net operating losses (NOL) incurred after Dec. 31, 2017, to 80% of taxable income rather than the historical 100%. This change was overshadowed by the Coronavirus Aid, Relief, and Economic Security (CARES) Act and eventually was delayed to tax years beginning after Dec. 31, 2020.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.