Loading

Get Ny Rp-6704-a1 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY RP-6704-A1 online

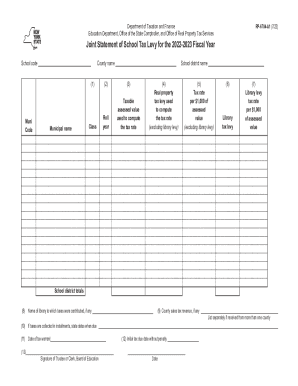

Filling out the NY RP-6704-A1 form is essential for indicating the school tax levy for your municipality for the 2022-2023 fiscal year. This guide aims to provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the NY RP-6704-A1 form online.

- Click ‘Get Form’ button to access the NY RP-6704-A1 document and open it in the editor.

- In the first section, enter the school code and municipal code corresponding to your district. These codes identify the specific school district and municipality involved.

- For the class column, designate whether the line of data is for the homestead or non-homestead class by entering 'H' for homestead and 'N' for non-homestead, if applicable.

- Input the assessment roll year in which the taxes are levied into the appropriate field.

- Enter the taxable assessed value used to compute the tax rate in the next field. Ensure that you include only the assessed value after all applicable exemptions.

- Fill in the real property tax levy that is used to compute the tax rate, ensuring that you do not include any library tax amounts in this figure.

- In the following field, provide the tax rate per $1,000 of assessed value calculated for your municipality.

- If your school district imposes a library tax, record the amount of the library levy allocated to the appropriate municipality.

- Then, enter the library tax rate per $1,000 of assessed value for each municipality, if applicable.

- If your district receives county sales tax revenue, document the county name and the revenue amount. List details separately if from multiple counties.

- Specify any installment payment due dates in the appropriate section.

- Record the date of the tax warrant for clarity.

- Conclude by entering the initial tax due date without penalty and ensure the form is signed by a designated trustee or clerk of the board of education.

- Once all sections are completed, you can save your changes, download the document, print it, or share it as necessary.

Complete and file your NY RP-6704-A1 online today to ensure compliance with tax requirements.

The 2% levy limit affects the tax cap calculations for 676 school districts and 10 cities with fiscal years starting July 1, 2022, including the “Big Four” cities of Buffalo, Rochester, Syracuse and Yonkers. Track state and local government spending at Open Book New York.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.