Loading

Get Mo Mo-crp 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-CRP online

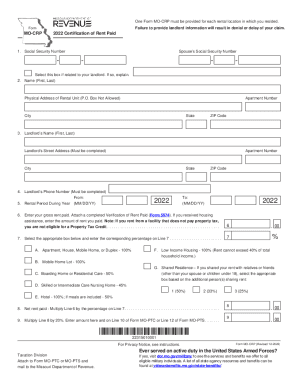

Filling out the Missouri Certification of Rent Paid (MO MO-CRP) form online can be straightforward if you follow the right steps. This guide will walk you through each section of the form, ensuring you provide the necessary information accurately.

Follow the steps to fill out the MO MO-CRP form online

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter your Social Security Number in the designated field, ensuring that it is accurate and formatted correctly.

- Indicate whether the information pertains to your landlord by selecting the appropriate box and providing an explanation if necessary.

- Complete the section with your name, including first and last names.

- Provide the physical address of your rental unit, making sure to include the apartment number, city, state, and ZIP code, as P.O. Boxes are not allowed.

- Fill in your landlord's name with their first and last names, followed by their street address, apartment number, city, and state.

- Enter your landlord’s phone number; this field is required.

- Specify the rental period during the year by providing the start and end dates in MM/DD/YY format.

- Input the total gross rent you paid for the specified rental period. Attach a completed Verification of Rent Paid (Form 5674) as necessary.

- If you received housing assistance, include the rent amount you actually paid.

- Select the appropriate box regarding your rental type and enter the corresponding percentage in Line 7.

- Calculate your net rent paid by multiplying the amount in Line 6 by the percentage you indicated in Line 7.

- Multiply the net rent paid by 20% and enter that amount in the specified field.

- After completing all fields, review the form for accuracy before saving changes, downloading, or printing the document.

Complete your MO MO-CRP form online and ensure your claim is processed smoothly.

The applicable statute of limitations for such collections to initiate a civil suit for the collection of delinquent taxes is five (5) years from the date of finality of the assessment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.