Loading

Get Wi Wt-4 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WI WT-4 online

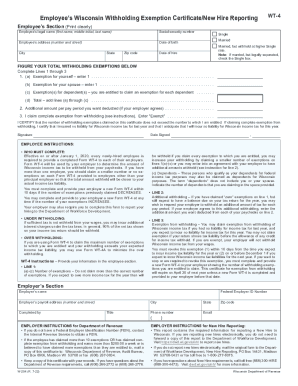

The WI WT-4 form is a crucial document for newly hired employees in Wisconsin, allowing employers to determine the appropriate amount of state income tax to withhold from employees' paychecks. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring you complete it accurately and efficiently.

Follow the steps to successfully complete the WI WT-4 online.

- Press the ‘Get Form’ button to access the WI WT-4 form and open it for editing.

- Begin by filling in your legal name, including your first name, middle initial, and last name in the designated field.

- Next, enter your social security number accurately in the appropriate section.

- Provide your current address, including the number and street, city, state, and zip code.

- Indicate your date of birth in the specified format.

- Select your marital status by marking the appropriate box: Single, Married, or Married but withholding at a higher Single rate. Note that if you are married but legally separated, you should check the Single box.

- Enter your date of hire in the designated space.

- Calculate your total withholding exemptions by completing Lines 1 through 3. In line 1(a), indicate 1 for yourself; in line 1(b), enter 1 for your spouse if applicable; and in line 1(c), list your dependents. Finally, total these exemptions in line 1(d).

- In line 2, if agreed by your employer, you can specify an additional amount you want deducted from each pay period.

- In line 3, if you qualify, you may claim complete exemption from withholding by entering 'Exempt' and certifying your eligibility.

- Ensure you sign and date the form to certify your claims regarding the number of exemptions.

- Once completed, you can save your changes, download, print, or share the form as necessary.

Complete your WI WT-4 form online today for accurate tax withholding.

How to fill out a W-4: step by step Step 1: Enter your personal information. ... Step 2: Account for all jobs you and your spouse have. ... Step 3: Claim your children and other dependents. ... Step 4: Make other adjustments. ... Step 5: Sign and date your form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.