Loading

Get Il Dor Il-941-x 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL DoR IL-941-X online

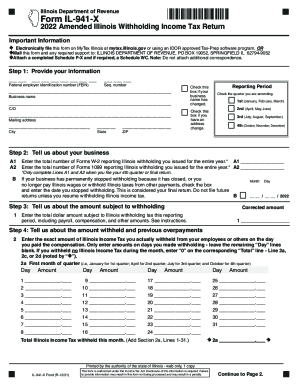

The IL DoR IL-941-X form is designed for amending your Illinois withholding income tax return. This guide provides clear, step-by-step instructions to help you navigate the online filing process with ease.

Follow the steps to complete your IL-941-X form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Provide your information. Enter your federal employer identification number (FEIN), your business name, and check the box if you have changed your business name or mailing address.

- Select the reporting period for which you are amending the return by checking the appropriate quarter box.

- Enter the total number of Forms W-2 and 1099 that reported Illinois withholding you issued for the entire year, if applicable.

- Indicate if your business has permanently stopped withholding and enter the stop date if this is your final return.

- Input the corrected amount subject to Illinois withholding tax for the reporting period.

- Fill in the amounts withheld for each month of the quarter, ensuring to document the exact amounts of withholding on the respective days.

- Calculate the total Illinois income tax withheld that month and add the totals from all three months.

- Detail any payments and credits being used, including credits from Schedule WC.

- Figure your balance by subtracting total payments and credits from the amount owed, and determine if you have an overpayment.

- Sign and date the form, affirming the accuracy of your return. Include information for any paid preparer if applicable.

- Finally, save your changes. You can download, print, or share your completed form as needed.

Complete your IL DoR IL-941-X form online today for a smooth filing experience.

Complete and attach to Form IL-941-X to verify Illinois income and withholding records. This form is required. Note: Check the box in the first column if the income and withholding information for the payee or employee has changed. This form is authorized under the Income Tax Act.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.