Loading

Get Mo Dor 2643 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO DoR 2643 online

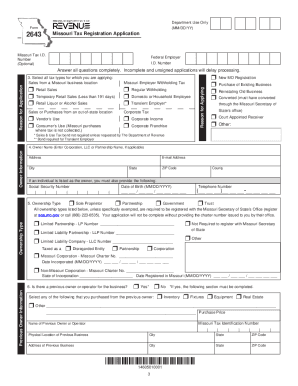

Filling out the MO DoR 2643, also known as the Missouri Tax Registration Application, online can streamline the process of registering your business for various tax types. This guide provides detailed step-by-step instructions to help you navigate each section of the form effectively.

Follow the steps to complete the MO DoR 2643 online.

- Use the ‘Get Form’ button to access the MO DoR 2643. This will allow you to download the form in an editable format.

- Begin by entering a Missouri Tax Identification Number if you have one. If not, leave this field blank.

- Input your Federal Employer Identification Number (FEIN). This number is essential for identifying your business for tax purposes.

- Select your business ownership type from the options provided, including sole proprietorship, partnership, or corporation. Ensure to include the charter number if applicable.

- If applicable, fill in details about a previous owner and any items purchased from them, including inventory or fixtures.

- Specify the business mailing address and physical location. Avoid using a P.O. Box.

- Document the names and roles of officers, partners, or members responsible for tax matters, including their social security numbers and dates of birth.

- Complete sections on sales or use tax if relevant, including the estimated sales for tax purposes and the filing frequency.

- Provide a brief description of your business activity, including the products sold or services provided.

- Review all the information you provided for accuracy and completeness before submission.

- Once all fields are filled out, save the form changes. You may then download, print, or share the completed form as needed.

Start filling out your MO DoR 2643 online today to ensure your business is properly registered for tax compliance.

You're required to file a Missouri tax return if you receive income from a Missouri source. There are a few exceptions: You're a Missouri resident, and your state adjusted gross income is less than $1,200. You're a nonresident, and your Missouri income was less than $600.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.