Loading

Get Irs 4797 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 4797 online

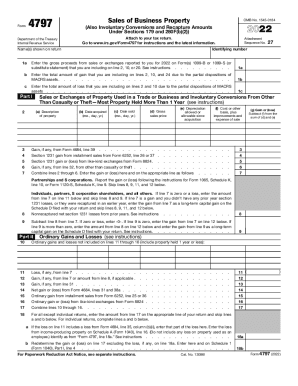

Filling out the IRS Form 4797 is essential for reporting the sale of business property, as well as involuntary conversions and recapture amounts. This guide provides clear, step-by-step instructions for users, regardless of their tax experience, to assist them in completing the form accurately online.

Follow the steps to fill out the IRS Form 4797 correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will enter the gross proceeds from sales or exchanges as reported on Form(s) 1099-B or 1099-S. For line 1a, input these figures accurately as they are crucial for your overall calculation.

- Continue to lines 1b and 1c where you will enter the total amount of gain and loss respectively that you are including due to the partial dispositions of MACRS assets.

- Complete the property details in Part I. For each property, fill out the description, acquisition date, sale date, gross sales price, and the cost or other basis including any improvements or sale expenses.

- In line 7, combine the figures from lines 2 through 6 to determine the overall gain or loss. Ensure you input the correct values, as this affects further calculations.

- Move to Part II and report any ordinary gains and losses not captured previously. Fill out the necessary lines by transferring the appropriate amounts from your prior calculations or worksheet notes.

- Proceed to Part III to report any gains from the disposition of property under specific sections, where detailed property information must be filled out for accurate reporting.

- Lastly, in Part IV, you will report recapture amounts under Sections 179 and 280F(b)(2) as necessary. This requires entering both the section 179 expense deduction and any recomputed depreciation amounts.

- Review all entered information for accuracy. Once complete, you can save changes, download, print, or share the form as needed.

Complete your IRS 4797 form online today for accurate reporting of your business property transactions.

Most deals are reportable with Form 4797, but some use 8949, mainly when reporting the deferral of a capital gain through investment in a qualified opportunity fund or the disposition of interests in such a fund. Use Form 4797 for sales, exchanges, and involuntary conversions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.