Loading

Get Mo Mo-1065 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MO-1065 online

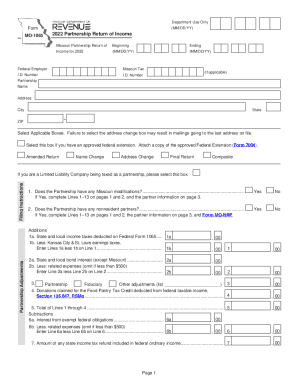

The MO MO-1065 is the Missouri Partnership Return of Income form, essential for partnerships operating in Missouri to report their income. This guide provides detailed, step-by-step instructions tailored to help users effectively complete the form online.

Follow the steps to fill out the MO MO-1065 with ease.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the partnership name and address in the designated fields, including city, state, and ZIP code. This information is crucial for identifying the partnership.

- Indicate the beginning and ending dates for the income period of 2022 in the MM/DD/YY format.

- Fill out the Federal Employer Identification Number (FEIN) and, if applicable, the Missouri Tax Identification Number.

- Select any applicable boxes for address changes, final return, or composite return. Ensure you check the box if you have an approved federal extension.

- Answer the questions regarding Missouri modifications and nonresident partners by selecting 'Yes' or 'No'. Depending on your answers, complete the indicated lines accordingly.

- Complete the Partnership Adjustments section as necessary, detailing any additions or subtractions to the income.

- Sign the return in the signature area, including the printed name and date signed of the general partner or preparer.

- Review the completed information for accuracy before submitting the form.

- After confirming all details are correct, you can save changes, download, print, or share the form as needed.

Complete your MO MO-1065 online today to ensure timely and accurate filing.

Related links form

Form 1065 is an information return used to report the income, gains, losses, deductions, credits, and other information from the operation. of a partnership. Generally, a partnership doesn't pay tax on its. income but passes through any profits or losses to its partners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.