Loading

Get Irs 1040 Schedule 8812 Instructions 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule 8812 Instructions online

Filling out the IRS 1040 Schedule 8812 can initially seem daunting, but this step-by-step guide will help you understand its components and how to complete it effectively online. This form is crucial for determining your child tax credit, credit for other dependents, and additional child tax credit.

Follow the steps to fill out the Schedule 8812 Instructions accurately.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Begin by identifying your qualifying children and dependents. Make sure each has a valid TIN (SSN, ITIN, or ATIN) prior to your tax return’s due date.

- Complete the Dependents section on page 1 of Form 1040 or 1040-SR by checking the appropriate boxes for each child, including those eligible for the child tax credit and credit for other dependents.

- In Part I of Schedule 8812, add the number of children qualifying for the child tax credit. Report this on line 4 of the form.

- On line 6, provide the count of dependents eligible for the credit for other dependents. Ensure that no child is counted for both credits.

- Calculate your additional child tax credit in Part II. Begin by entering your earned income in line 18a. Refer to the Earned Income Worksheet if necessary.

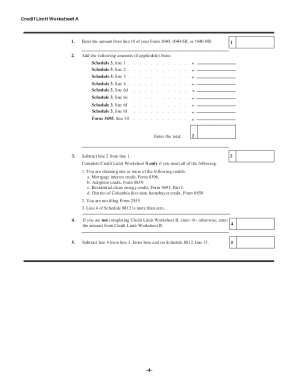

- Complete any required calculations from the Credit Limit Worksheets, including determining the total nontaxable combat pay and Medicare tax.

- Once all relevant information is filled, verify that all fields are accurate and complete any additional instructions as necessary.

- At the conclusion, you can save your changes, download, print, or share the completed form as needed.

Complete your IRS forms online with confidence to ensure accurate filing and maximum credits.

The amount of credit owed to you will vary based on your income level, but if your total credit amount exceeds the amount of tax that you owe, the IRS requires you to file Form 8812.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.