Loading

Get Be Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Be Form online

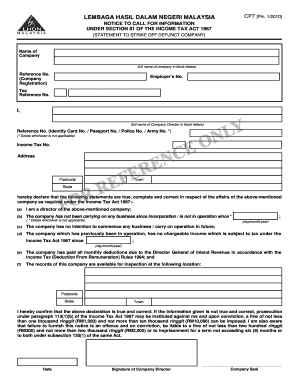

Filling out the Be Form online involves providing detailed information regarding your company's status in accordance with the Income Tax Act 1967. This guide offers a comprehensive step-by-step approach to ensure you accurately complete the form.

Follow the steps to fill out the Be Form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Enter the full name of the company in block letters in the designated field. Ensure accuracy as this will be the primary identification of the company.

- In the reference number field, input the company's registration number. This is essential for verification purposes.

- Fill in the employer’s number and tax reference number accordingly. This information is vital for tax-related communication.

- State your full name as the company director in block letters. This identifies you as the official representative for this declaration.

- Provide your reference number, which can be your identity card number, passport number, police number, or army number. Delete the options that do not apply to you.

- Enter the income tax number next. This helps in linking your declaration to your tax records.

- Input your address, including postcode, town, and state to ensure accurate communication from tax authorities.

- Confirm your status as a director of the company by checking the corresponding box.

- State whether the company has not been carrying on any business since its incorporation or if it is not currently operational. Delete the option that does not apply.

- Indicate the date when the company has no intention to commence any business or operations in the future by entering the day, month, and year.

- If applicable, provide the date since the company has had no chargeable income subject to tax.

- Confirm that all monthly deductions due to the Director General of Inland Revenue have been paid as required by entering the company’s records location.

- Finally, review the information for accuracy. Once completed, you can save your changes, download the form, print it, or share it as needed.

Complete your documents online today to ensure compliance and avoid potential penalties.

To fill out a dividend tax return, gather all relevant information about your dividends received throughout the tax year. Enter this information in the appropriate fields, ensuring accuracy in reporting. Remember to review your entries for clarity and compliance with tax regulations. Be Form simplifies dividend reporting and guides you through the filing procedure.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.