Loading

Get Irs 8752 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8752 online

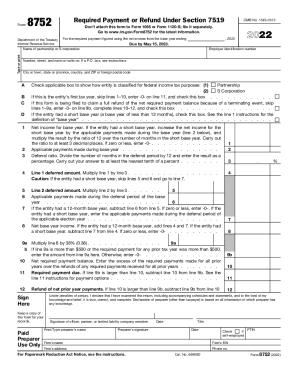

Filling out the IRS 8752 form accurately is essential for partnerships and S corporations that have made a section 444 election. This guide will provide clear, step-by-step instructions to assist users in completing the form online with confidence.

Follow the steps to complete the IRS 8752 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the necessary identification information at the top of the form. This includes the name of the partnership or S corporation, employer identification number, and the address details.

- Select the applicable classification of the entity for federal income tax purposes by checking the appropriate box for either 'Partnership' or 'S Corporation'.

- If this is the entity's first tax year, check the box provided. If applicable, check the box if you are filing due to a terminating event or if the entity had a short base year.

- In line 1, enter the net income for the base year, ensuring that if there is a short base year, you adjust it by applicable payments and multiply by the ratio of 12 over the number of months in the base year.

- For line 2, list any applicable payments made during the base year which are not guaranteed payments.

- Calculate the deferral ratio in line 3, dividing the number of months in the deferral period by 12, and enter it as a percentage.

- Complete lines 4 to 12, following the instructions for each line, ensuring calculations for deferred amounts and required payment are accurate.

- Sign the form in the indicated area, certifying that the information provided is true and complete.

- After ensuring all fields are complete, save your changes, and you can then download, print, or share the form as needed.

Ensure compliance by completing and filing your IRS 8752 form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you lost your refund check, you should initiate a refund trace: Use Where's My Refund, call us at 800-829-1954 and use the automated system, or speak with an agent by calling 800-829-1040 (see telephone assistance for hours of operation).

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.