Loading

Get Ct Au-724 2022

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT AU-724 online

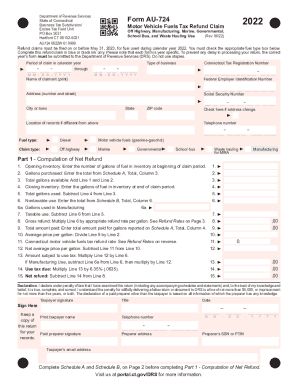

The CT AU-724 form is designed to claim a refund for motor vehicle fuels tax for specific uses in Connecticut. This guide will provide you with step-by-step instructions on how to accurately complete the form online, ensuring that you meet all necessary requirements for a successful submission.

Follow the steps to successfully complete your CT AU-724 refund claim

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Indicate the period of the claim by entering the start and end dates in the format M-M - D-D - Y-Y-Y-Y.

- Select the type of business by checking the appropriate box provided on the form.

- Provide your Connecticut Tax Registration Number in the designated field.

- Fill in the name of the claimant by printing it clearly.

- Enter your Federal Employer Identification Number (FEIN) and Social Security Number (SSN) as required.

- Complete the address section with the relevant street address, city, state, and ZIP code.

- If your address has changed, check the box indicating an address change.

- Specify the location of records if it differs from your address provided above.

- Select the fuel type by checking either diesel or motor vehicle fuels (gasoline‑gasohol).

- Choose the claim type from the options listed: off highway, marine, governmental, school bus, or waste hauling for MIRA.

- Proceed to Part 1 and compute your net refund by following the directions provided, systematically filling in the corresponding lines.

- Ensure that you declare your information is true and correct, signing where indicated.

- Review your completed form for accuracy before saving your changes.

- Finally, choose to download, print, or share your form as needed for your records.

Complete your CT AU-724 refund claim online today for a seamless tax refund experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you e-filed your return and chose direct deposit to receive your refund, you'll usually receive your refund in 8-15 days. However, you should allow an extra 1-5 business days for your bank to process the funds.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.