Loading

Get Buyer''s Affidavit For Firpta Withholding Exemption

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Buyer's Affidavit For Firpta Withholding Exemption online

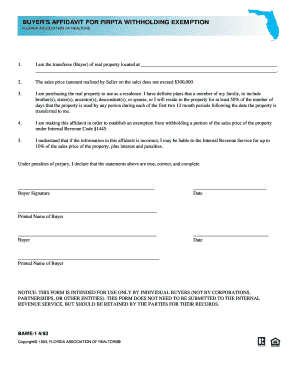

Completing the Buyer's Affidavit For Firpta Withholding Exemption is a crucial step for buyers looking to purchase real estate while ensuring compliance with federal tax regulations. This guide will walk you through each section of the form, providing clarity and support as you fill it out online.

Follow the steps to successfully complete your affidavit.

- Press the ‘Get Form’ button to access the Buyer's Affidavit For Firpta Withholding Exemption and open it in your preferred digital platform.

- In the first section, clearly state the location of the real property you are purchasing by filling in the address, including street number, street name, city, state, and zip code.

- Confirm that the sales price you are paying for the property does not exceed $300,000. This is critical for qualifying for the withholding exemption.

- Indicate that the real property is being purchased as a residence. You must affirm that you or a member of your family will occupy the property for at least 50% of the time during the first two years after transfer.

- Acknowledge that you are filling out this affidavit to claim an exemption from withholding as outlined under Internal Revenue Code §1445.

- Understand and accept the potential liability for inaccuracies in the information provided in this affidavit, which may incur penalties from the Internal Revenue Service.

- Provide your signature and the date on which you are filling out the form. Make sure that your printed name is also included.

- Repeat the signature and date process for any additional buyers listed, ensuring all details are completed accurately.

- After filling out the entire form, review all entries for errors or omissions. Once satisfied, you can save the form, download a copy for your records, print, or share it as needed.

Complete your essential documents online to streamline your real estate process.

The Foreign Investment in Real Property Tax Act (FIRPTA) is a tax imposed on the amount realized from the sale of real property owned by a foreign seller. There are exceptions to this tax-withholding requirement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.