Loading

Get Al Sr2 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AL SR2 online

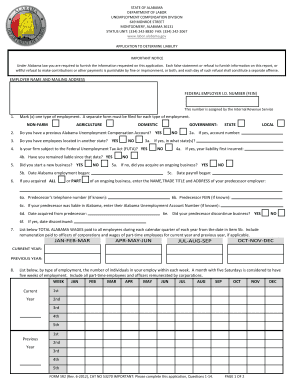

The AL SR2 form is essential for determining liability related to unemployment compensation in Alabama. This guide provides a clear and supportive overview of how to fill out the form accurately and efficiently online.

Follow the steps to complete the AL SR2 form online.

- Click the ‘Get Form’ button to obtain the AL SR2 form and open it in the editor.

- Enter your employer name and mailing address in the designated fields, alongside your Federal Employer Identification Number (FEIN) assigned by the IRS.

- Mark one type of employment from the provided options: Non-farm, Agriculture, or Domestic. Remember that a separate form is required for each type of employment.

- Indicate whether you have a previous Alabama Unemployment Compensation account by selecting 'Yes' or 'No'.

- Specify if your business has employees located in another state by selecting 'Yes' or 'No'.

- State if your firm is subject to the Federal Unemployment Tax Act (FUTA) by selecting 'Yes' or 'No'. If applicable, indicate if you have remained liable since that date.

- If you have started a new business, select 'Yes' or 'No', and provide the date when Alabama employment began.

- If you acquired part or all of an ongoing business, provide the name, trade title, and address of your predecessor employer, alongside their FEIN if known.

- List the total Alabama wages paid to all employees for each calendar quarter from the date set in item 5b. This should include remuneration for all employees.

- Fill out item 9 entirely, detailing each location and type of operation. Use the accompanying instruction sheet for assistance.

- Select the appropriate form of organization for your business from the provided options and indicate your tax filing status with the IRS if required.

- List personal details such as the full names and social security numbers of individual owners, partners, or officers.

- Decide whether you wish to voluntarily elect coverage under Alabama law, marking 'Yes' or 'No'.

- Enter your business location and the contact details of the person responsible for the submission, ensuring to include an email address for communication.

- Finally, certify that the information provided is true and correct, and sign and date the form where indicated.

- Once completed, you may save your changes, download, print, or share the AL SR2 form as needed.

Complete your AL SR2 form online today to ensure a smooth filing process.

Filing for unemployment for the first time in Alabama involves several steps. You’ll need to gather necessary documents such as your Social Security number and employment history. Then, you can complete the application online, by phone, or in person at local employment offices. Resources like AL SR2 provide detailed guidance to simplify this process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.