Loading

Get Comparing Financial Institutions Worksheet Answers 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Comparing Financial Institutions Worksheet Answers online

This guide provides a comprehensive overview of how to accurately fill out the Comparing Financial Institutions Worksheet Answers online. By following these steps, users can ensure they compare financial institutions effectively based on their specific needs.

Follow the steps to complete the Comparing Financial Institutions Worksheet Answers.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

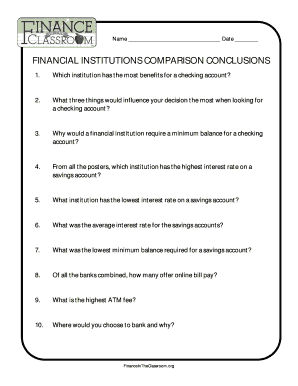

- Begin by reviewing the first question regarding the benefits of checking accounts. Analyze the options available and indicate which institution you believe offers the most benefits.

- Move to the second question, where you will identify three key factors that influence your decision when choosing a checking account. Consider aspects such as fees, interest rates, and customer service.

- The third question addresses minimum balance requirements for checking accounts. Reflect on why financial institutions might impose this condition based on your research.

- Proceed to questions four and five, where you'll determine which institution offers the highest and lowest interest rates for savings accounts, respectively. Use the available data to make your selections.

- For question six, calculate the average interest rate for savings accounts based on your findings. Ensure you double-check your calculations for accuracy.

- Question seven requires you to identify the lowest minimum balance required for a savings account. Review your gathered information to find this detail.

- In question eight, count how many banks offer online bill pay services. This data can typically be found on each institution's website.

- Identify the highest ATM fee for question nine. Verify the fees listed by each institution to finalize your answer.

- Conclude with question ten, where you will express your personal banking choice and rationalize your decision with the information you have gathered.

- Once all questions are completed, review your form for accuracy. You can then choose to save changes, download, print, or share the completed document as needed.

Complete the Comparing Financial Institutions Worksheet Answers online today to assess your financial options.

There are three major types of depository institutions in the United States. They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.