Loading

Get Mn Dor Schedule M1wfc 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MN DoR Schedule M1WFC online

The Minnesota Department of Revenue Schedule M1WFC is a crucial form for claiming the Working Family Credit. This guide will provide you with a comprehensive, step-by-step approach to filling out the form online, ensuring you understand each section and field clearly.

Follow the steps to successfully complete your Schedule M1WFC

- Click ‘Get Form’ button to obtain the Schedule M1WFC form and open it in the online editor.

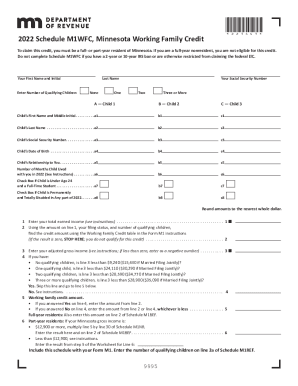

- Enter your first name and initial along with your last name in the designated fields. Ensure that you input your Social Security number accurately.

- Indicate the number of qualifying children you have by selecting from the options: none, one, two, or three or more.

- For each qualifying child, fill out the required details including their first and last name, Social Security number, date of birth, relationship to you, and the number of months each child lived with you during 2022.

- If applicable, check the boxes if any child is under age 24 and a full-time student, or if they were permanently and totally disabled at any point during the year.

- Complete line 1 by entering your total earned income. Consult the instructions if needed.

- Using the earned income amount from line 1, along with your filing status and number of qualifying children, find the appropriate credit amount from the Working Family Credit table included in the form.

- Fill out line 3 by entering your adjusted gross income. If this amount is less than zero, enter it as a negative number.

- Follow the instructions for line 4 to determine if you are eligible to skip to line 5 or if further qualification checks are required.

- Enter the credit amount on line 5 according to the response to line 4.

- For part-year residents, complete line 6 as directed based on your Minnesota gross income.

- Lastly, ensure you include the completed Schedule M1WFC with your Form M1 and enter the number of qualifying children on line 2a of Schedule M1REF.

Complete your Schedule M1WFC online to ensure you claim your Working Family Credit without delays.

Minnesota Withholding Tax is state income tax you as an employer take out of your employees' wages. You then send this money as deposits to the Minnesota Department of Revenue and file withholding tax returns. Withholding tax applies to almost all payments made to employees for services they provide for your business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.