Loading

Get Ga Dor G-1003 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR G-1003 online

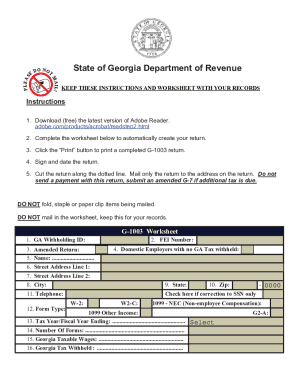

The GA DoR G-1003 form is essential for reporting withholding information in the state of Georgia. This guide will walk you through the process of accurately filling out the form online, ensuring compliance and ease of submission.

Follow the steps to complete the GA DoR G-1003 form online.

- Press the ‘Get Form’ button to access the GA DoR G-1003 form in your browser. This will allow you to begin the completion process online.

- Input your GA withholding ID in the designated field. This ID is essential for identifying your account with the Department of Revenue.

- Fill in your Federal Employer Identification (FEI) number. This number helps track your business for tax purposes.

- Indicate if you are submitting an amended return by checking the appropriate box.

- Enter the name of the person or entity submitting the form in the 'Name' section.

- Provide the street address, city, state, and zip code of the person or entity. Ensure all information is correct to avoid delays.

- Input a valid telephone number where you can be reached for any inquiries or clarifications.

- If applicable, check the box for corrections to Social Security Numbers.

- Select the form type from the options provided: W-2, W2-C, 1099-NEC, or 1099 Other Income. Choose the one relevant to your situation.

- Enter the tax year or fiscal year ending date in the designated field to specify the period the return covers.

- Specify the number of forms you are submitting.

- Complete the section for Georgia taxable wages, detailing the relevant income.

- Fill in the Georgia tax withheld amount to report the taxes that were taken from wages.

- Once all fields are accurately filled, review your form for errors and then save your changes.

- You may choose to download, print, or share the completed form as needed for record-keeping or submission.

Complete your GA DoR G-1003 form online easily and efficiently today.

2021 Tax Year Individual Standard Deductions Amounts Single/Head of Household/Qualifying Surviving Spouse - $4,600. Married Filing Jointly - $6,000. Married Filing Separately - $3,000. Additional Deduction of $1,300 if: Taxpayer or spouse turns age 65 before the close of the tax year, or.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.