Loading

Get Hawaii State D60 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Hawaii State D60 Form online

Filling out the Hawaii State D60 Form can simplify the process of salary assignment or cancellation. This guide provides a clear step-by-step approach to help users complete the form accurately and efficiently online.

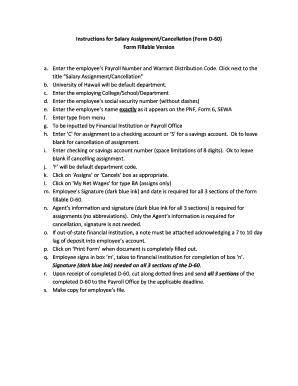

Follow the steps to fill out the Hawaii State D60 Form:

- Click ‘Get Form’ button to access the form and open it in the editor.

- Enter the employee's Payroll Number and Warrant Distribution Code next to the title 'Salary Assignment/Cancellation'.

- The University of Hawaii will be the default department; confirm or adjust if necessary.

- Input the employing College/School/Department.

- Enter the employee's social security number without dashes.

- Type the employee's name exactly as it appears on the PNF, Form 6, or SEWA.

- Select the type from the menu provided.

- This section will be inputted by the Financial Institution or Payroll Office.

- Enter 'C' for assignment to a checking account or 'S' for a savings account; leave blank for cancellation.

- Input the checking or savings account number (limited to 8 digits); leave blank if cancelling the assignment.

- 'F' will be the default department code.

- Select the appropriate box for 'Assigns' or 'Cancels'.

- For type BA (assigns only), click on 'My Net Wages'.

- The employee's signature in dark blue ink and date are required for all three sections of the form.

- Agent's information and signature in dark blue ink are required for assignments. Only the agent's information is needed for cancellations; signature is not required.

- If using an out-of-state financial institution, attach a note acknowledging a 7 to 10 day lag in deposits.

- Once the document is completely filled out, click on 'Print Form'.

- The employee signs where indicated, then takes it to the financial institution to complete the agent's information.

- After receiving the completed D-60, cut along the dotted lines and send all three sections to the Payroll Office by the applicable deadline.

- Make a copy for the employee's file.

Complete your forms online for a more efficient processing experience.

You can file an amended Hawaii state tax return by submitting Form N-101A, Amended Hawaii State Tax Return. Be sure to provide the necessary corrections and include any supporting documentation. Services like US Legal Forms offer easy access to these forms, making amendments straightforward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.