Loading

Get Mi Dot Mi-1041 2021-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT MI-1041 online

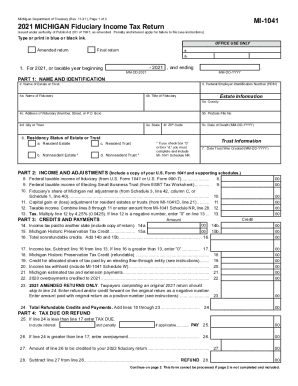

Filling out the MI DoT MI-1041 online can seem daunting, but this guide is designed to help you navigate the process with ease. Follow these detailed steps to ensure accurate completion of the Michigan Fiduciary Income Tax Return.

Follow the steps to accurately complete the MI DoT MI-1041 form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online platform.

- Begin with Part 1, where you will provide the name and identification details. Fill in the name of the estate or trust, the Federal Employer Identification Number (FEIN), and the name and title of the fiduciary. Ensure you complete the address fields accurately.

- Continue to indicate the residency status of the estate or trust. Select whether it is a resident estate, resident trust, nonresident estate, or nonresident trust. If applicable, remember to complete the MI-1041 Schedule NR.

- Input the date of death for the estate (if applicable), as well as the date the trust was created, both in the format MM-DD-YYYY.

- Proceed to Part 2, where you will report income and adjustments. Enter the federal taxable income from U.S. Form 1041 or U.S. Form 990-T, along with any other necessary figures related to income adjustments.

- In Part 3, detail any credits and payments. Record income tax paid to another state, if applicable, and document any other credits, including the Michigan Historic Preservation Tax Credit.

- Conclude by reviewing Part 4. Here, calculate whether you owe tax or are due a refund. Ensure all lines are complete, especially the totals reflecting tax due or refundable credits.

- Once you have filled out all sections and verified the information for accuracy, save your changes. You may have the option to download, print, or share the completed form as necessary.

Start filling out your MI DoT MI-1041 online today for a seamless tax filing experience.

Form 1041 And you are not enclosing a check or money order...And you are enclosing a check or money order...Internal Revenue Service P.O. Box 409101 Ogden, UT 84409Internal Revenue Service P.O. Box 409101 Ogden, UT 844092 more rows • 29 Nov 2022

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.