Get How To Make A Fillable Tax Receipt Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Make A Fillable Tax Receipt Form online

Filling out the How To Make A Fillable Tax Receipt Form online is a crucial task for charities to ensure compliance with the Income Tax Act. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to accurately fill out your tax receipt form.

- Click ‘Get Form’ button to access the form and open it in your digital document editor.

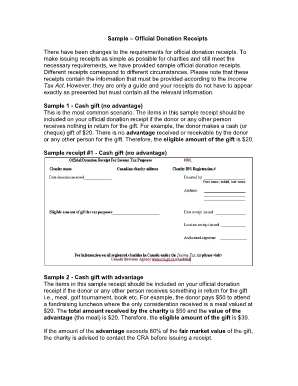

- Complete the 'Charity name' field by entering the official name of your charity as registered with the appropriate authority.

- Fill in the 'Canadian charity address' with the complete address of your charity as recognized by the authorities.

- Enter the 'Charity BN/ Registration#' which is the registration number assigned to your charity.

- In the 'Date donation received' section, indicate the exact date for cash donations or the year for non-cash gifts.

- Document the 'Total amount received by charity', reflecting the monetary value of the donation received.

- Provide the 'Fair market value' of the property, defining the highest price the property would achieve in a free market.

- Describe the 'Value of advantage' which is the total worth of any benefits given to the donor.

- Calculate the 'Eligible amount of gift for tax purposes', ensuring this reflects what the donor can claim.

- Provide a brief 'Description of property' received by your charity if applicable, including notable details.

- List the 'Appraised by' name and 'Address of appraiser' if the property was appraised, noting the appraisal is recommended for valuables over $1,000.

- Include 'Donated by' which contains the name and address of the donor.

- Document the 'Date receipt issued' indicating when the receipt should be officially recognized.

- Record the 'Location receipt issued' to specify where the donation acknowledgement took place.

- Finally, ensure the 'Authorized signature' is included from an individual designated by the charity to confirm the receipt.

- Once you have completed all the fields, make sure to save your changes, and you can choose to download, print, or share the completed form as needed.

Start filling out your tax receipts online today to ensure accuracy in documentation.

Making a tax invoice receipt involves writing a clear document that outlines the transaction details, including both seller and buyer information. Make sure to include dates, payment terms, and a breakdown of items sold. Creating a standardized receipt can save time and prevent errors. For those seeking simplicity, learning how to make a fillable tax receipt form with the help of US Legal Forms can streamline this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.