Loading

Get Mi 5081 Instruction 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI 5081 Instruction online

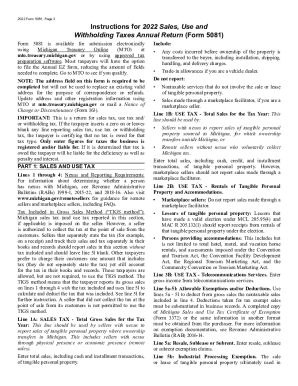

The MI 5081 Instruction is an essential form for reporting sales, use, and withholding taxes in Michigan. This guide will walk you through the process of completing this form online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete the MI 5081 Instruction online.

- Press the ‘Get Form’ button to access the MI 5081 Instruction form and open it in your preferred editing tool.

- Start with Part 1: Sales and Use Tax. Fill in your total gross sales for the tax year on Line 1A, ensuring to include all relevant sales transactions and associated costs.

- Continue to Line 1B to report use tax for sales sourced from Michigan. Ensure to include only qualifying sales, particularly those made outside of Michigan.

- If applicable, move to Line 2B to report rentals of tangible personal property. Clarify exemptions related to marketplace facilitators.

- Note Line 5a through 5l for allowable exemptions and deductions. Make sure you substantiate any claims with proper documentation from your business records.

- Complete Part 4: Summary, where you'll enter any overpayments for refunds or additional taxes owed if applicable.

- Finally, review your entries for accuracy. You can then save your changes, download the form, print it, or share it as necessary.

Complete your MI 5081 Instruction online today for a seamless filing experience.

Michigan's 2023 withholding guide was released by the state treasury department. The state uses a flat 4.25% tax rate. The value of a state allowance increased to $5,400, up from $5,000 in 2022, the guide said. The state's taxable limits on pension and retirement benefit payments are also adjusted each year.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.