Loading

Get Mi Dot 4594 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI DoT 4594 online

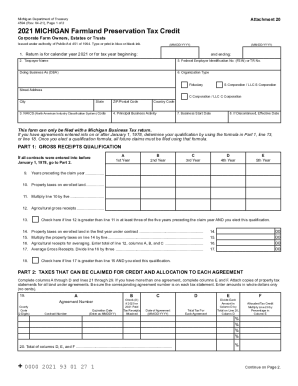

The MI DoT 4594 form enables Michigan farmland owners to claim tax credits by preserving their agricultural land. This guide provides a step-by-step approach to filling out the form online in a clear and concise manner.

Follow the steps to successfully complete the MI DoT 4594 form.

- Click the 'Get Form' button to obtain the form and open it in the editor.

- Begin by entering the tax year. In line 1, specify the calendar year 2021 or enter the tax year start and end dates in MM-DD-YYYY format.

- Complete the taxpayer's name in line 2, followed by the federal employer identification number (FEIN) or tax registration number in line 5.

- In line 6, select the appropriate organization type from the provided options: Fiduciary, S Corporation, C Corporation, or Limited Liability Company (LLC).

- Enter the NAICS (North American Industry Classification System) code in line 3, identifying your business's type.

- Fill in your principal business activity in line 4.

- Provide the business start date in line 7 and, if applicable, the effective date for discontinued operations in line 8.

- Proceed to Part 1: Gross Receipts Qualification, starting with line 9 to indicate the years preceding the claim year.

- In line 10, enter the property taxes for each year reported on line 9 that are attributable to land enrolled on or after January 1, 1978.

- Calculate the agricultural gross receipts and report them in line 12.

- Complete the required qualification checks in lines 13 through 17. Depending on your situation, you may use either the total or average receipts formula.

- Move to Part 2 and list taxes that can be claimed for credit in columns A through D for any existing agreements.

- For multiple agreements, ensure to complete any additional copies of page 1 as needed.

- Finally, review your entries for accuracy, then save changes, download, and print or share the completed form as required.

Take action to complete your MI DoT 4594 form online and ensure you receive your tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

In Michigan, the assessed value is equal to 50% of the market value. Local assessors determine how much a given property could sell for on the market, usually by looking at factors such as size, features and the prices of recently sold comparable properties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.