Loading

Get Wa Lcb Liq-870 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WA LCB LIQ-870 online

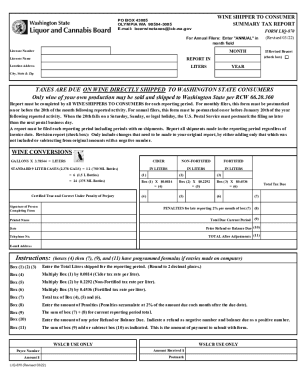

Filling out the WA LCB LIQ-870 form is an essential step for wine shippers to consumers in Washington State. This guide provides clear, user-friendly instructions, ensuring that you can complete the online form accurately and efficiently.

Follow the steps to successfully complete the WA LCB LIQ-870 online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

- Enter the reporting month in the appropriate field. For annual filers, be sure to include 'ANNUAL' in this field.

- Input your licensee number in the designated section to ensure your report is properly identified.

- If you are submitting a revised report, check the appropriate box to indicate this adjustment.

- Enter your licensee name clearly in the designated field to ensure proper identification.

- Fill in the total liters of wine shipped during the reporting period, rounding to two decimal places.

- Complete the location address section, which includes your city, state, and zip code.

- Calculate taxes due for each type of wine reported. Use the established rates: multiply the liters shipped for cider by 0.0814, for non-fortified wine by 0.2292, and for fortified wine by 0.4536.

- Sum the total tax amounts from the previous calculations to find the total tax due.

- If applicable, enter any penalties for late reporting—2% per month of the total tax due.

- Add the total tax due and any penalties to find your total due for the current reporting period.

- Enter any prior refund or balance due, indicating refunds as negative amounts.

- Ensure the form is certified true and correct by signing and dating in the appropriate sections.

- Finally, save, download, print, or share the completed form as needed.

Complete your WA LCB LIQ-870 form online today to ensure compliance.

selling beer in Washington. The tax applies to each 31-gallon barrel or its equivalent in cans and bottles. Beer is also subject to retail sales tax, whether purchased in the original container or for consumption on-premises of the seller. Tax exemptions may reduce the tax liability for this tax base.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.