Loading

Get Fl Dr-486 2022-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DR-486 online

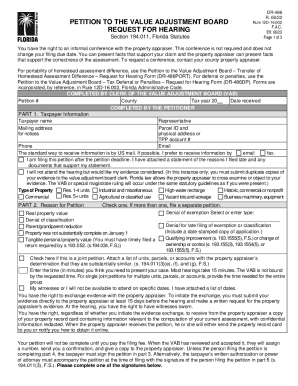

The FL DR-486 form is used to petition the Value Adjustment Board regarding tax assessments in Florida. This guide provides a straightforward approach to accurately filling out the form online, ensuring that all necessary information and documentation is submitted correctly.

Follow the steps to fill out the FL DR-486 form online.

- Press the ‘Get Form’ button to acquire the FL DR-486 form and open it in your editor.

- Begin with Part 1, Taxpayer Information. Fill in your name, mailing address, phone number, and email address. Specify if you prefer to receive information via email or fax, and include your Parcel ID or TPP account number.

- Indicate whether you are filing the petition after the deadline and provide a statement of reasons for the late filing if applicable. Make sure to attach any supporting documents.

- Select the type of property you are petitioning for by checking the appropriate box. Options include residential, commercial, agricultural, and more.

- In Part 2, Reason for Petition, check the specific grounds for your petition, such as denial of exemption or property value concerns. If necessary, file a separate petition for multiple reasons.

- Estimate the time you will need for your hearing, keeping in mind that most hearings are typically 15 minutes.

- Complete the taxpayer signature section in Part 3. If someone is representing you, they must also sign in Part 4 or Part 5, depending on their qualifications.

- Review the form for accuracy and completeness. Ensure all signatures are in place before submitting.

- Once completed, you can save changes, download a copy, print the form, or share it as required.

Complete your FL DR-486 form online today to ensure your petition is submitted promptly.

A taxpayer may file a petition with the Value Adjustment Board if he or she feels the Property Appraiser's assessment, classification or exemption status for their property is not correct. The VAB is an independent entity and is not affiliated with the Property Appraiser or the Tax Collector.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.