Loading

Get Az Dor Form 322 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AZ DoR Form 322 online

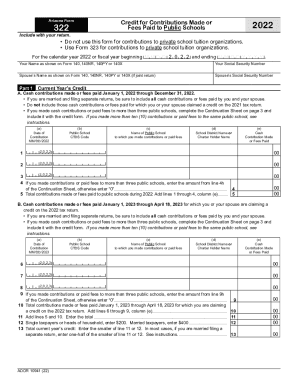

Filling out the AZ DoR Form 322 online is a straightforward process that allows you to claim tax credits for contributions made to public schools. This guide will help you navigate each section of the form with clarity and ease.

Follow the steps to complete the AZ DoR Form 322 online effectively.

- Press the ‘Get Form’ button to access the AZ DoR Form 322. This will enable you to open the form in an editable format.

- Begin by filling in your name as it appears on your tax return (Form 140, 140NR, 140PY, or 140X) along with your Social Security number. If applicable, also provide your spouse’s name and Social Security number for joint returns.

- In Part 1, specify the cash contributions or fees paid from January 1, 2022, through December 31, 2022. Fill in the date, public school CTDS code, name of the public school, school district or charter holder name, and the amount contributed.

- Include contributions from January 1, 2023, through April 18, 2023, in Part 1, following the same format as in step 3. If you made contributions to more than three public schools, be sure to complete the Continuation Sheet on page 3.

- Calculate the total contributions made or fees paid for the year, as outlined in the instructions on the form. Be mindful of the limits specified for single and married taxpayers.

- In Part 2, report any available credit carryover from prior years, providing necessary details in the corresponding fields for each taxable year.

- In Part 3, enter the current year’s credit, the available credit carryover, and then calculate the total available credit by adding the entries from Part 1 and Part 2.

- After completing all sections of the form, review your data for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Complete your AZ DoR Form 322 online today to ensure you receive the tax credits you deserve.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.