Loading

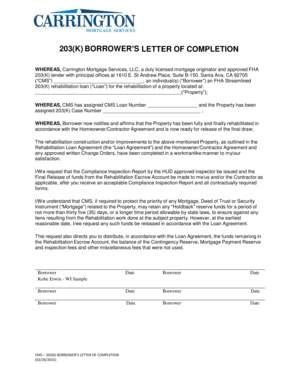

Get Loan Completion Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Loan Completion Letter online

This guide provides clear and detailed instructions on how to complete the Loan Completion Letter online. Whether you are a seasoned user or new to digital document management, you will find this guide helpful in ensuring accurate completion of the form.

Follow the steps to complete the Loan Completion Letter effectively.

- Click ‘Get Form’ button to access the Loan Completion Letter and open it in your preferred online editor.

- In the first section, enter the name of the borrower in the space provided, ensuring to include any relevant co-borrower names as necessary.

- Fill in the property address where the rehabilitation has occurred in the designated field.

- Enter the CMS Loan Number assigned to your loan. This information can usually be found in your loan documents.

- Input the 203(K) Case Number associated with your property, obtained from your lender or loan documents.

- Affirm the rehabilitation has been completed by checking the appropriate box or providing a brief description if necessary.

- Request the Compliance Inspection Report by entering your expectations for the report and any relevant details for the inspector.

- Indicate your understanding regarding the potential retention of 'Holdback' reserve funds and provide any additional instructions as needed.

- Review all entries for accuracy and completeness before proceeding to save or submit your form.

- Once all sections are filled out correctly, you can save changes, download, print, or share the completed form according to your preferences.

Complete your Loan Completion Letter online today to ensure timely processing of your request.

A closure letter for a loan, commonly known as a loan completion letter, is an official document that confirms the full repayment of a loan. It serves as proof of satisfaction of obligations under the loan agreement. Having this letter is essential for your financial records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.