Loading

Get Ky 42a741 2006-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 42A741 online

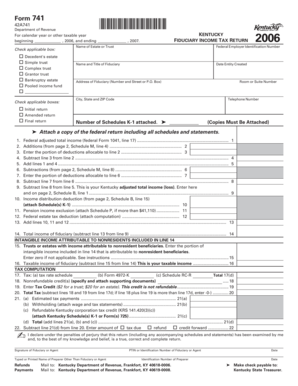

Filing the KY 42A741 form is an important step for managing fiduciary income tax in Kentucky. This guide provides clear, step-by-step instructions to help you navigate through each section of the form effectively.

Follow the steps to complete the KY 42A741 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar year or other taxable year information in the provided fields marked ‘beginning’ and ‘ending’.

- Select the applicable box for the type of entity by checking the options like decedent's estate, simple trust, or complex trust.

- Indicate whether this is an initial, amended, or final return by checking the respective boxes.

- Fill in the name of the estate or trust, the federal employer identification number, and the name and title of the fiduciary.

- Provide the date the entity was created, as well as the complete address and telephone number of the fiduciary.

- Input the number of Schedules K-1 attached, and ensure you attach a copy of the federal return, including all schedules and statements.

- Complete the income and deduction calculations, starting with the federal adjusted total income on line 1 and proceeding through the subsequent lines that involve additions, subtractions, and taxable income.

- Record the total income of fiduciary on line 14 and calculate the taxable income in line 16.

- Complete the tax computation section, entering any nonrefundable credits and calculating the total tax.

- Declare the amounts related to estimated tax payments, withholding, and refunds in the designated sections.

- Sign and date the form, ensuring that it is completed accurately and truthfully.

- At the final step, users can save changes, download, print, or share the form as needed.

Take the next step in managing your fiduciary income tax by completing the KY 42A741 online today.

Kentucky does not require you to use the same filing status as your federal return. Generally, all income of Kentucky residents, regardless of where it was earned, is subject to Kentucky income tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.