Loading

Get Ky 42a741 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY 42A741 online

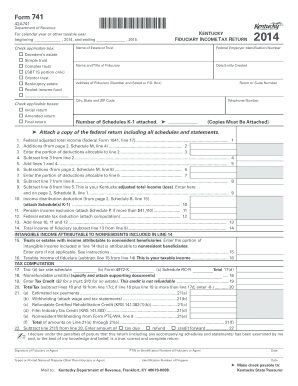

The KY 42A741 is an important form for Kentucky fiduciary income tax returns. This guide provides users with a clear, step-by-step walkthrough for completing this form online, ensuring accurate submissions and compliance with state regulations.

Follow the steps to complete the KY 42A741 online successfully.

- Click the ‘Get Form’ button to access the form and open it in your selected online editor.

- Enter the calendar year or other taxable year in the fields provided at the top of the form. This typically involves filling in the starting and ending dates.

- Check the box corresponding to the type of entity for which you are filing the return. Options include decedent's estate, simple trust, complex trust, grantor trust, and more.

- Indicate whether this is an initial, amended, or final return by checking the appropriate box.

- Fill in the name of the estate or trust, followed by the federal employer identification number (EIN).

- Complete the name and title of the fiduciary, the date the entity was created, and the fiduciary's address including street, room, city, and ZIP code.

- Provide the telephone number of the fiduciary.

- Count and enter the number of Schedules K-1 that are attached to the return.

- Complete the income and deduction sections on the form, ensuring to follow the specific instructions provided for each line.

- Review the taxable income calculation and ensure all lines are completed accurately before moving to the tax computation section.

- Fill in the tax computation, ensuring to apply any nonrefundable credits and calculate the total tax due.

- Complete the declaration section with the signature of the fiduciary or agent, as well as their printed name and identification information.

- After completing all sections, you can save the changes, download the form, print physical copies, or share the form as needed.

Prepare and file your KY 42A741 online today for a smooth tax filing experience.

Related links form

A full-year resident of Kentucky files Form 740 and a person who moves into or out of Kentucky during the year or is a full-year nonresident files Form 740-NP.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.