Get Usda Income Calculation Worksheet

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Usda Income Calculation Worksheet online

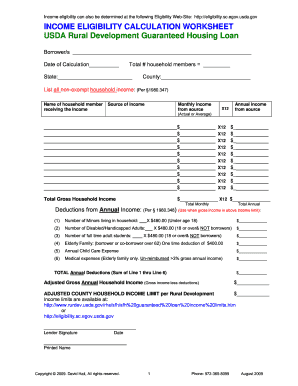

Filling out the Usda Income Calculation Worksheet is an essential step for determining income eligibility for USDA Rural Development Guaranteed Housing Loans. This guide provides step-by-step instructions to help users navigate the form online with ease and confidence.

Follow the steps to complete your income calculation worksheet

- Click ‘Get Form’ button to access the Usda Income Calculation Worksheet and open it for editing.

- Begin by filling in the borrower(s) details at the top of the form, including the date of calculation, total number of household members, state, and county.

- In the 'List all non-exempt household income' section, enter the name of each household member receiving income, the source of that income, the monthly income amount, and calculate the annual income by multiplying the monthly income by twelve (X12). Repeat this for all household members.

- After you have listed all income sources, sum up the annual income amounts to calculate the total gross household income. This will be reflected in both total monthly and total annual income fields.

- Next, move to the 'Deductions from Annual Income' section. Complete the fields by entering the number of minors, disabled adults, and full-time adult students in your household. Multiply each number by the respective deduction amount as indicated in the form.

- Include any additional deductions, such as a one-time deduction for elderly family members and annual child care or medical expenses. Carefully add all deductions to get the total annual deductions amount.

- Calculate the adjusted gross annual household income by subtracting the total annual deductions from the total gross household income.

- Finally, reference the adjusted county household income limit and ensure your income is within the allowable limits. Each participating lender must sign the form and provide their printed name and date to complete the process.

- Once you have filled out all the required sections, you can save your changes, download, print, or share the completed worksheet as needed.

Get started on completing your Usda Income Calculation Worksheet online today!

The Debt-to-Income (DTI) ratio for USDA loans in 2025 is an important metric used to evaluate a borrower's financial health. Typically, this ratio should not exceed 41% for most applicants when using the Usda Income Calculation Worksheet. However, applicants with strong credit scores may qualify for a DTI as high as 45%. By effectively utilizing the Usda Income Calculation Worksheet, you can accurately assess your income and expenses, ensuring you stay within this critical limit.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.